Watch: What is a tariff? The BBC's Adam Fleming explains

US President Donald Trump has paused his latest round of higher tariffs against some of America's trading partners.

Taxes on goods imported from 60 countries he had described as the "worst offenders" took effect on 9 April.

But Trump later said those higher rates for some countries would be paused for 90 days, with a blanket 10% tariff to apply in the meantime.

At the same time he hiked tariffs on Chinese products to 125%.

Trump has said tariffs will boost US manufacturing and protect jobs, but economists warn that the move could harm the world economy and push up prices for consumers in the US and around the globe.

What are tariffs and how do they work?

Why is Trump using tariffs?

For decades, Trump has argued the US should use tariffs to boost its economy.

He says they will encourage US consumers to buy more American-made goods, increase the amount of tax raised and lead to huge levels of investment in the country.

Trump wants to reduce the gap between the value of goods the US buys from other countries and the value of those it sells to them. He argues that America has been taken advantage of by "cheaters" and "pillaged" by foreigners.

The US president has also made other demands alongside tariffs. The first wave announced during his current term targeted China, Mexico and Canada, after he said he wanted them to do more to stop migrants and illegal drugs reaching the US.

Trump has strongly defended his tariff policy but a growing number of influential voices within his Republican Party have joined opposition Democrats and foreign leaders in attacking the measures.

The argument has even split the White House team, with tariff policy sparking a recent personal spat between Elon Musk and Trump's trade adviser Peter Navarro.

Getty

Getty

Trump's tariffs are expected to significantly disrupt US car production and put up prices

What are Trump's 'reciprocal tariffs'?

Trump introduced a minimum 10% tariff on all imports to the US on 5 April.

The UK, Argentina, Australia, Brazil and Saudi Arabia are among the countries whose goods face this "baseline" charge.

Much higher tariffs were initially introduced against 60 other countries on 9 April.

These included 49% on Cambodian products, 46% on Vietnamese imports and 20% on goods from the EU.

Chinese imports were initially due to face 54% tariffs (34% on top of the 20% rate already in place). Trump then increased the total to 104% after China vowed to "fight to the end" and refused to scrap its own retaliatory tariffs of 34% on the US.

Hours after the 104% tariff took effect, China announced it would introduce a significantly higher 84% tax on all US imports from 10 April.

Trump soon hit back, saying the US would increase tariffs on Chinese goods to 125% effective immediately.

For now, Chinese manufacturers - and American consumers - still benefit from a tariff exemption for goods in small parcels sent from China worth less than $800 (£624). However that exemption will also end on 2 May.

These items will be subject to a duty rate of 90% or $75 per item - increasing to $150 per item after 1 June.

White House officials have described the higher tariffs as "reciprocal".

Reciprocal would mean they were based on the amount countries charge the US in the form of existing tariffs, plus the cost of meeting non-tariff barriers such as regulations.

However, the White House used a different calculation - setting each tariff rate at a level that would eliminate the US's trade deficit in goods with each country.

And some countries, including the UK, have had tariffs applied even though they buy more from the US than they sell to it.

The White House confirmed that some specific goods are exempt - including copper, pharmaceuticals, semiconductors, energy and "other certain materials that are not available in the United States".

Trump has said he plans to remove the exemption for pharmaceutical goods to help shift drug production to America, but it is not clear if or when this might happen.

Trump had also previously announced 25% tariffs on goods from Mexico and Canada, and a 10% tariff on Canadian energy imports before introducing a number of exemptions and delays.

He has also brought in 25% tariffs on all steel and aluminium imports, and foreign-made cars. A 25% tariff on car parts is due to start no later than 3 May.

Trump's escalation with China has now put a question mark over US trade with the European Union. The EU, too, has approved retaliatory tariffs against the US, which will come into effect on 15 April.

Will prices go up for US consumers?

Many economists expect tariffs to push up prices across a range of imported goods, as firms pass on some or all of their increased costs.

The products affected could include everything from clothing to coffee and alcohol to electronics.

Some firms may also decide to import fewer foreign goods, which could make those which are available more expensive.

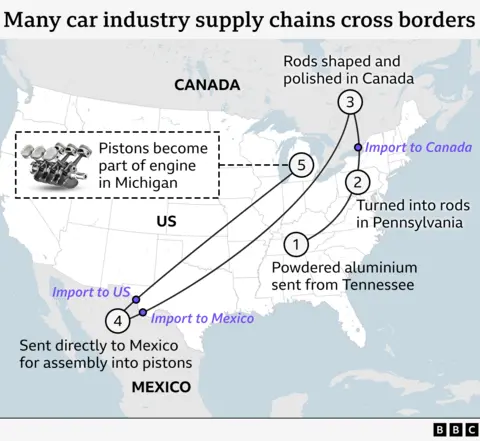

The price of goods manufactured in the US using imported components may also rise.

For example, car parts typically cross the US, Mexican and Canadian borders multiple times before a vehicle is completely assembled.

Car prices had already been expected to increase as a result of earlier tariffs.

The cost of a car made using parts from Mexico and Canada alone could rise by $4,000-$10,000 (£3,035 - £7,588) depending on the vehicle, according to analysts at the Anderson Economic Group.

The measures could also damage the US economy.

The chance of a recession rose to 50% after Trump's announcement on new tariffs, according to former International Monetary Fund (IMF) chief economist Ken Rogoff.

Trump's top officials have repeatedly played down recession fears, and insisted that the tariffs would be implemented as planned.

What has happened to stock markets?

Trump's tariffs announcement has caused significant volatility on global stock markets.

Stock markets are where firms sell shares in their business. They reflect the best guess of what every company in the world is worth and what their future profits will be.

Share prices have been hit because investors think the new tariffs will increase costs and reduce profits.

Many people are affected by stock market falls - even if they don't invest in shares directly - because of the knock-on effect on pensions, jobs and interest rates.

But after Trump announced the 90-day pause, US markets rebounded sharply.

How will Trump's tariffs affect the UK?

PA Media

PA Media

The UK exported around £58bn of goods to the US in 2024, mainly cars, machinery and pharmaceuticals.

It was already due to be affected by the earlier tariffs targeting steel, aluminium and car imports.

Prime Minister Sir Keir Starmer said "clearly there will be an economic impact" from the 10% tariff. However, he said US-UK trade talks are ongoing, and that he will "fight for the best deal for Britain".

The UK government has so far not announced any taxes on US imports. However, it is drawing up a list of US products it could hit with retaliatory tariffs.

How have other countries responded to Trump's tariffs?

EU chief Ursula von der Leyen warned that "the consequences will be dire for millions of people around the globe".

27 EU members approved a list of US products to be taxed in three stages beginning on 15 April, hours before Trump announced his pause and 10% plans.

Italy's Giorgia Meloni - a Trump ally - said the reciprocal tariffs were "wrong" but that she would work towards a deal with the US to "prevent a trade war".

In the Republic of Ireland, Micheál Martin said there was "no justification" for "deeply regrettable" tariffs which benefitted "no-one".

Canada introduced a 25% tariff on some vehicles from the US on 9 April.

Australia's Anthony Albanese said "this is not the act of a friend".

South Korea's acting president Han Duck-Soo said "the global trade war has become a reality".

Japan said the 24% levy against its products was "extremely regrettable" and could violate World Trade Organization and US-Japan agreements.

.png)

1 month ago

26

1 month ago

26