Kevin PeacheyCost of living correspondent

Getty Images

Getty Images

Debt charities say they are receiving an influx of calls as people worry their financial situation has slipped towards becoming unmanageable.

The first weeks of January are usually the busiest time of year for helplines following a particularly expensive period.

Advice charity StepChange said Monday was busier than any single day last year, and credit counselling service Money Wellness said a fifth of those accessing its services at the turn of the year did so between 22:00 and 03:00.

Dave Murphy is working his way out of debt and said demands from creditors could have become overwhelming, but he urged anyone struggling to ensure they asked for help - for their financial and mental wellbeing.

Money Wellness, which runs free debt and money advice services, said thousands of people had accessed its services on Christmas Eve and Christmas Day. Expanded assistance online allows people to increasingly find information outside of normal hours - including overnight.

Sebrina McCullough, its head of advice, said: "The numbers we're seeing over Christmas and New Year are unprecedented.

"People often feel pressure to celebrate the holidays, even when money is tight, and our data shows many are turning to us late at night when they feel most anxious."

Pressure of priority bills

StepChange's website had 3,958 visitors on Christmas Day, and 15,401 on New Year's Eve and 1 January combined.

Many may have simply been exploring their options, but calls came in thick and fast at the start of the month. While not at the level of the energy crisis of a few years ago, call numbers were notably up on last year.

The Money Advice Trust, which runs National Debtline, said the first working days of January had seen more calls than last year.

Monday was the busiest single day in its history, when 1,365 calls came in.

Concerns are particularly acute for those struggling to pay priority bills such as council tax and rent.

The colder weather could also place extra strain on vulnerable households, with £4.4bn already owed to energy suppliers following a period of high prices, although the government's cold weather payments have been triggered in many areas.

Charities are urging anyone whose debt has become unmanageable to seek help as soon as possible, rather than making matters worse by ignoring the situation.

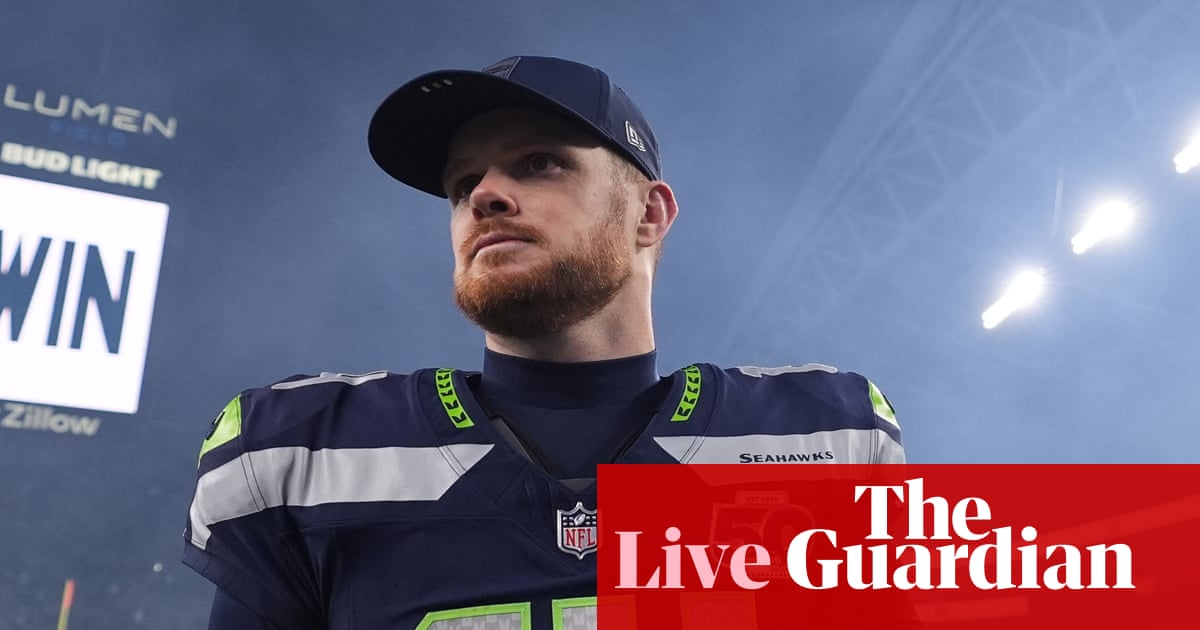

That is a view shared by Dave, who has managed to work his way out of difficulty.

A few years ago, he found his previously manageable credit card debt becoming a problem when he was unexpectedly made redundant at the same time as going through a divorce.

Dave has turned his finances around after receiving help from StepChange

"They were two quite dramatic things in six months," said Dave, who has previously spoken to the BBC about his debt issues.

"The debt was around £20,000 to £25,000 at its height. It became so overwhelming. You feel that you are letting creditors down because you want to do what they ask of you - but you are scared, you are renting, and at times you struggle to get through each day.

"Once you are in a spiral, it is really hard to get out of it."

He is now working in insurance, his debts are manageable and being paid off, and he said he wanted to help others "to show that you can get through these things".

Figures published earlier in the week by the Bank of England fuelled concerns that everyday costs were becoming harder for some households to manage without turning to borrowing.

The data showed that credit card borrowing grew at the fastest annual rate in nearly two years in the run-up to Christmas.

The annual growth rate for credit card borrowing increased to 12.1% in November, from 10.9% the previous month - the highest figure since January 2024 when it was 12.5%.

.png)

1 month ago

26

1 month ago

26