Hazel ShearingEducation correspondent

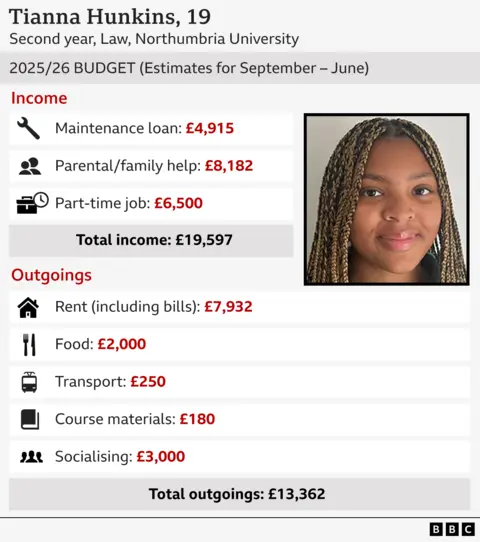

Tianna Hunkins

Tianna Hunkins

Tianna's maintenance loan does not cover her rent

As the clock counted down to 16:00, Tianna Hunkins braced herself for a mad rush.

She had been given a shift at a nearby fast food restaurant that started precisely when her lecture ended.

Luckily, she was already wearing her uniform under a hoodie, so "nobody would know".

"I always make it on time," she says.

The 19-year-old is one of a growing number of students juggling paid work alongside their studies because maintenance loans don't cover their living costs.

Recent research from the Higher Education Policy Institute (Hepi) suggests students in England need £61,000 over a three-year degree "to have a minimum socially acceptable standard of living".

The think tank found the maximum annual maintenance loan covers "just half the costs faced by freshers", while a Save the Student survey published this week suggested that, on average, maintenance loans have fallen short of covering living costs – by £502 per month.

From 30-hour working weeks to two-hour commutes from their family home, students have been speaking to the BBC about the lengths they're going to in order to make up the maintenance loan shortfall - even with family help.

Tianna is grateful her parents can pay for her accommodation, so her student loan can be spent on other living costs

"I wouldn't put myself through this stress [of a job alongside studying] if I didn't have to," says Tianna, who is from Nottingham but has just returned to Newcastle for her second year at Northumbria University.

Tianna is set to receive a £4,915 maintenance loan for this academic year, which is far below what she needs to cover her rent (£7,932).

She's grateful her parents can help pay for her accommodation, so her maintenance loan can cover food, transport, socialising and pricey law books.

She also plans to save money from her part-time work for a house deposit.

But for Tianna, part of the appeal of going to university was the chance to embrace hobbies and make friends - so she knew she had to find a part-time job to fund her busy social life, as well as sports like netball and ice skating.

After applying for "over 100 jobs" she landed a contract at a fast-food chain in the second term of first year. She soon found herself working about 30 hours a week - often finishing at 02:00.

With public transport done for the day by that time, Tiana would shell out £8 for an Uber ride to avoid walking alone at night - and to give herself more sleep ahead of 09:00 lectures.

Sometimes working involved making sacrifices.

"One of my friends got an opportunity to do a legal internship through this paralegal event that I wasn't able to go to because I was at work," she says. "I missed out on that."

The amount students can borrow for living costs has risen in England, Wales and Northern Ireland this year.

The maximum maintenance loan for students from England living away from their parents outside of London, for example, is now £10,544. The amount you can borrow depends on your household income.

But still, more and more students are working part time to cover their costs.

Recent research from Hepi and Advance HE suggested that 68% of UK students were in paid employment during term time, up from 35% in 2015.

BBC/ Josh Parry

BBC/ Josh Parry

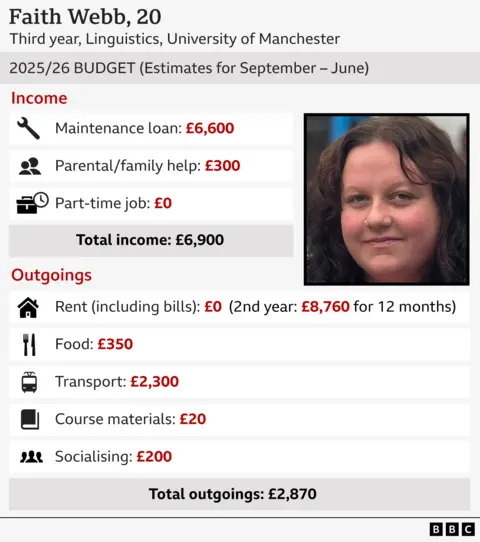

Faith couldn't afford to rent on her own in third year, so she decided to move back home with her family and commute to university

Faith Webb, 20, says she sees "a lot of people in lectures in a work uniform" on her linguistics course at the University of Manchester.

Faith's maintenance loan covered the cost of her halls in first year, but wasn't enough to pay for her room in the flat she rented with friends in second year.

This year her loan is £6,600. With many of her friends not renting this year, she was faced with the prospect of moving back into halls - which she didn't want to do because she didn't enjoy that in first year - or renting alone, which she couldn't afford.

So, Faith chose a third option.

"I've decided to move back home and commute to uni rather than living in Manchester itself," she says

Home, for Faith, is with her parents in Birkenhead, Wirral.

Her new commute will mean catching a 06:30 bus to Liverpool, a train to Manchester, and a 20-minute walk. She expects it to take around an hour and a half each way and to cost £2,300 for the year.

She is planning on treating university "like a nine 'til five", studying on campus every day between classes.

But it will sometimes mean missing out on seeing friends in the evening at the Taylor Swift society.

"If I've been away from home since 06:00, I wouldn't really have any motivation," she says.

Faith has chosen to commute rather than picking up a term-time job because she would "rather focus more on the education… while I have the opportunity".

"I'm paying so much money to do this," she adds.

Prof Andy Long, vice chancellor and chief executive at Northumbria University, says around 38% of students commute to his university.

"It's not a lifestyle choice," he says. "[It's] an additional burden that students having the traditional university experience simply don't have to deal with."

Northumbria University is holding dedicated freshers events to build a sense of community among commuter students this term, and is looking into whether contact hours can be condensed into fewer days to help them and those with part-time jobs.

He says, like other universities, students have been able to apply for deadline extensions because of working commitments in recent years, and have the option to catch up on recorded lectures when they can't attend in person.

"It's supposed to reinforce what you have learned in the lecture, but obviously for those students, that may not be a choice for them," he says.

Prof Long wants the Department for Education (DfE) to reintroduce maintenance grants in England when it publishes its post-16 white paper this autumn.

He says the amount that students can borrow for living costs should increase with inflation, and the household income threshold that determines which students receive the maximum maintenance loan should rise "significantly".

Skills minister Jacqui Smith says the government "recognises that too many students are facing real financial hardship".

She said she was "determined to deliver change" and that the DfE's white paper, would "soon set out how we plan to improve access for students from disadvantaged backgrounds".

Other students got in touch with the BBC via Your Voice, Your BBC News to share their financial concerns.

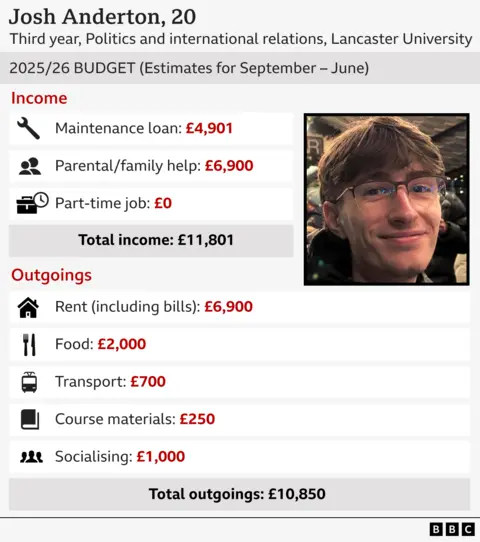

Josh Anderton is from Doncaster and studies politics and international relations at Lancaster University. He says he is considering walking for two hours a day to get to and from lectures because of bus fares. His maintenance loan covers about two thirds of his rent.

"I buy a bus pass, but it's just getting more and more expensive," he says, adding that it now costs £150 a term. "I think I'd rather walk at this point."

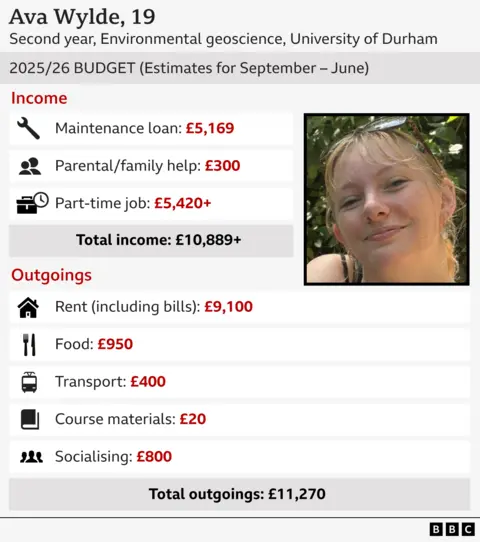

Ava Wylde, 19, has had to fork out on train fares to get from her family home in Southampton to Durham, where she studies environmental geoscience and works in a corner shop to pay her rent, as her maintenance loan only covers just over half of what she needs.

She enjoys her job, but feels like she's had less time to consolidate her notes since taking it on.

It can sometimes mean turning down events with her rugby club or nights out with friends - many of whom don't have term-time jobs, though some are trying to find one.

"Even if you know that you shouldn't be going out and spending money in the evenings, you really want to - and your friends want you to," she says. "It's quite hard to tell your friends, 'No, sorry, I can't'."

Tianna had to leave her fast-food job at the end of last term because she wasn't allowed to pause it for the summer holidays and come back.

She worked in a night club in Nottingham over the summer and hopes to get a job in a pub in Newcastle this year.

"I'm not doing [night club work] in uni because it's insane hours," Tianna says. "I literally finish at 04:00 - I'm not doing that when I've got to get up the next day."

Additional reporting by Kris Bramwell and Bernadette McCague

.png)

1 month ago

23

1 month ago

23