Lucy HookerBusiness reporter

Getty Images/ljubaphoto

Getty Images/ljubaphoto

There was no rise in the rate of income tax. Still, the Budget is likely to push up your tax bill before the end of this parliament.

That's because the chancellor has opted to freeze tax thresholds - the point at which you start to pay tax, and the point where you tip into paying a higher rate of tax - for another three years.

This is often dubbed a stealth tax because, unlike raising the headline rates, it is not obvious on your payslip.

It will hit you hardest if your income is close to one of the tax thresholds because more of what you earn will be dragged over the line, making it subject to a higher rate of tax.

About a million people who currently don't earn enough to pay income tax will be drawn into paying it.

That will include people living on the state pension, which is currently just under £12,000 a year but is set to rise. A part-time minimum wage earner, working just 18 hours a week will also pay income tax, according to the think tank, the Institute for Fiscal Studies (IFS)

People in Scotland will also see their tax free allowance frozen, although other tax bands there vary.

People will also pay more in National Insurance Contributions (Nics) as the threshold for starting to pay this is also being frozen.

How does it work?

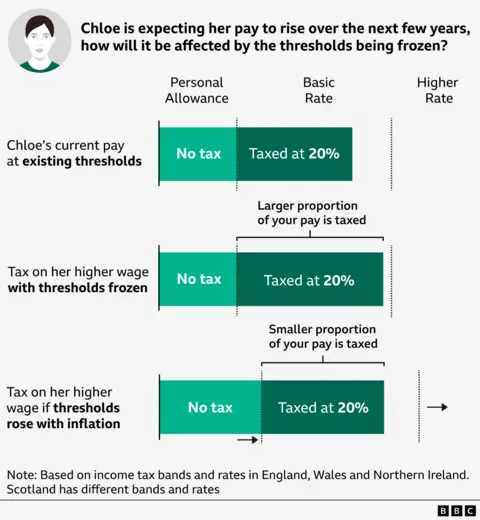

Wages usually go up year-on-year to cover the rising cost of living. Normally tax thresholds would also be lifted in line with rising prices.

However, due to the thresholds being frozen, as your pay rises, a bigger proportion of it will end up above the threshold and so being taxed.

For example, if you work full-time and are paid the minimum wage, you will pay £137 per year more in tax by 2030, than if those thresholds moved higher after 2028.

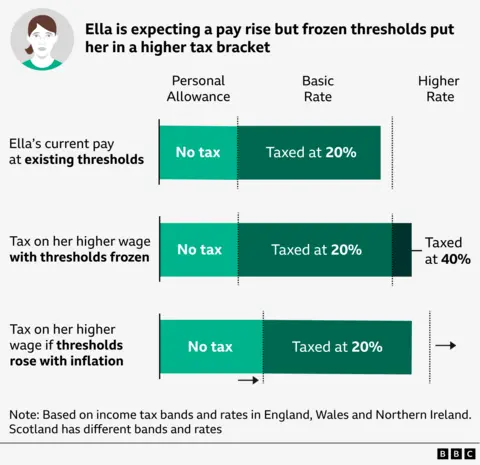

Will I pay the higher rate?

As incomes rise, frozen thresholds also mean more and more people will be dragged into the higher, 40% tax bracket.

For example, if you currently earn £49,000 and your pay rises with inflation, by 2031 you could be earning £54,000 meaning some of your income will be taxed at the higher rate for earnings over £50,271.

More than one in four employees will be higher rate tax payers by 2031, according to the IFS.

The same principle applies to the additional 45% rate, that is charged on a person's income over £125,140.

Will thresholds ever go back up?

Tax payers are already paying hundreds of pounds more than they would have been if thresholds had been allowed to rise with prices since 2021, when they were frozen by the previous government.

Inflation has been high in recent years, making the impact of frozen thresholds bigger.

By 2030 over five million more people are expected to have been brought into the taxpaying net by the policy.

In total the policy will have raised £56bn by 2031, £12bn from the three year extension just announced. That's money that helps pay for the NHS, schools and support for the sick, disabled and the elderly.

As things currently stand, thresholds are expected to start rising again in 2031.

However, there is no fundamental principle at stake, no size that is the "right" size for the tax free personal allowance. Before the financial crisis the personal allowance before you start paying tax was around £5,000, much smaller than today, even allowing for inflation, and it was allowed to grow until the pandemic hit.

.png)

7 hours ago

5

7 hours ago

5